The following CPA eligibility guide is written by one of my favorite readers, Moid Raza. He offers great insight to international candidates, especially those from Pakistan.

Certified Public Accountant (CPA) is one of the most prestigious and acclaimed professional certifications.

CPA is considered out of reach from Pakistani Bachelors due to lower credit hours as per the eligibility requirements in the United States.

As per my experience, becoming eligible for CPA is more difficult than CPA exam itself. However, after a lot of efforts, discussions, time and money (of course), I found certain ways that may help you to be eligible for CPA. BUT please note that this is a bumpy road as you may need to go for different courses which need efforts and time, in order to get this right in the first place. It needs determination and efforts!!! So if you are not committed, turn back now.

So let’s get started!!!!

State Requirements for CPA

There are 55 US States (including Guam and Porto Rico) where CPA exam is available. Each state has different Academic and Experience requirements for eligibility. National Association of State Boards of Accountancy (NASBA) is the official body for the state boards and you need to visit this site for more details on CPA Exams.

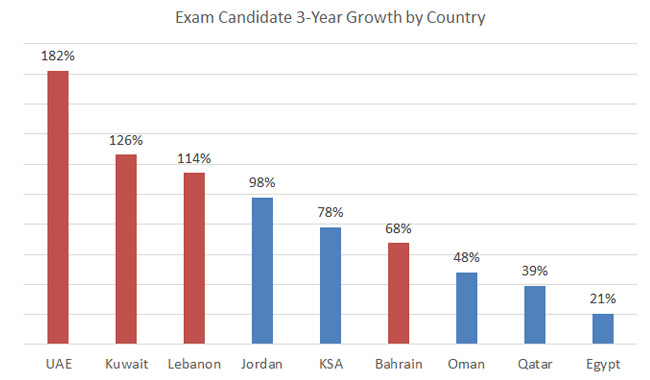

Since 2012, NASBA allowed certain international centers where the CPA exams are conducting. If you are a [citizen or long-term] resident in the appointed country, no need to visit your

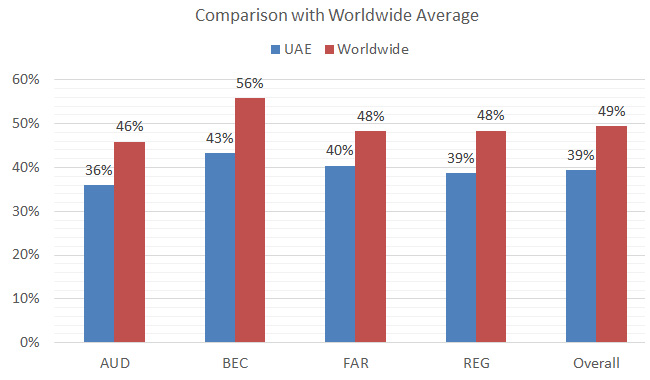

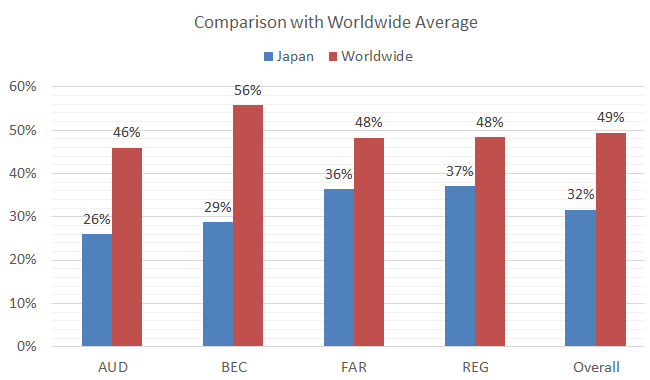

US state for CPA exam any more. The countries include GCC (Saudi Arabia, Kuwait, Qatar, UAE, Bahrain etc) and Japan. You need to check out this site for more details.

As international students, the Bachelor Degree is required to be evaluated by an approved evaluator.

Some states have specific evaluators and some have a list on their respective state websites. You need to be careful in selecting the evaluator as some evaluators have so many requirements that you need a lot of efforts to complete those. I will not go into detail of it as we should concentrate on the ones which we shall need. If you want to know the list of evaluators and further, Google is your best friend. Information is also available on NASBA website.

Additional Requirements for Licensing

We also need to understand one requirement which many people ignore and have problems later on. As a Pakistani Bachelor degree holder, we do not have adequate credit hours for CPA License.

Now, NASBA has made it mandatory for you to have a license if you have passed the exam. Once you pass your CPA exam, you need to complete the requirement of credit hours for license or else your grades shall expire after 3 years [if you are to sit for the exam in non-US locations].

However, there are certain states classified as Tier 1 and Tier 2. Tier 1 States require you to have license in order to be considered as CPA, however, for Tier 2 States, a certificate is initially provided which does not allow the individual full privileges as a CPA. After additional requirements are met, the certificate holder may receive a license or permit. You can find details on Licensing on this NASBA page.

Prior to 2012, NASBA considered Pakistani CA and ACCA as eligible academic education. However, since 2012, they considered it as a professional education, thus do not consider for credit hours requirements, except for a very few states. See I surprise you here too!!!

After a lot of efforts and discussion, as per my knowledge and experience, there are 2 states where you have a good chance of CPA eligibility.

- If you are not a qualified Accountant from ICAP or ACCA, Montana is the best available state for you.

- If you are a qualified CA or ACCA, Alaska is the best state for you, as they still consider CA and ACCA for eligibility, but till when, God knows

![:)]()

Why Montana?

Montana is a good choice for the following reasons:

- It has low credit hours requirement till now (24 semester hours)

- It allows International Testing

- It is a Tier 2 state which means if you pass your exam, you score will never expire, however, you cannot have a license, as explained earlier.

- You can get details of eligibility and other requirements here

(Update from Stephanie: Montana has become a 1-tier state effective July 1, 2015. Moid’s suggestion may no longer work)

Montana CPA Eligibility Step-by-step Guide

Please note that all the below steps are based on the following assumptions (based on my experience):

- Bachelor of Commerce from an HEC recognized University from Pakistan

- Unqualified Chartered Accountant (CA finalist, but it does not matter)

- Working in GCC (Kuwait specifically)

Here we need to understand the deficiencies for Eligibility first:

- Lacking 6 semester hours in Upper [Division] Accounting

- Lacking 3 semester hours in Taxation

- Time limits and durations

Please note, I will provide the guidance first and then the time line will be defined later i.e. what to do when.

Step 1 : Complete Education Requirements

To overcome this education deficiency, you may need to do certain courses from an accredited college or university. For the details you may visit this link.

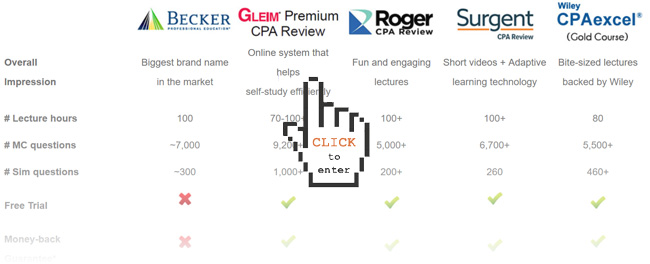

I personally prefer University of North Alabama (UNA). The details are in this link. As discussed with evaluator and personally I went with UNA for the following reasons:

- 3 courses for US$ 1,425 (US$ 475 each for 3 credit hours). Other colleges were relatively high

- Accepted by NASBA

- The course outline is the same as CPAexcel, which I feel is one of the best Review course of CPA, thus while studying these courses, you are studying for your CPA. Two birds with one stone

![:)]()

In order to complete the credit hours, you would need to complete the below 3 courses:

- AC 361P. (3 credit hours) Financial Reporting I.

- AC 462P. (3 credit hours) Federal Income Taxation I.

- AC 463P. (3 credit hours) Financial Statement Auditing

You would be wondering why auditing, because it was recommended to me by NASBA evaluator, as in Bachelors, Audit we studied was based on International Standards on Auditing (ISA) however, they consider US Generally Accepted Auditing Standards (GAAS) for eligibility.

By completing these 3 courses, you would be good to go for education side. As per my experience, it would take 6 to 9 weeks to complete these courses (based on work and other commitments). You would need to go and check for the date of entrance, course completion dates, syllabus of these courses, passing scores, forms submission etc through their website.

Step 2: Education Evaluation

The Bachelor of Commerce degree has to be evaluated by the authorized evaluator only. In case of Montana, Foreign Academic Credentials Service, Inc. (FASC) is the only evaluator they accept.

Please note that you need to send your original documents to FACS and they take 6 to 8 weeks (and 99% more than 8 weeks) to send the evaluation to Montana Board. Good thing is they take care of the originals well, so do not worry. The documents required are mentioned on their website along with the fee structure.

Stephanie’s update: Montana has now switched to NIES (NASBA International Evaluation Services) NIES is much faster but more expensive.

Step 3: Forms from Montana Board

You need to register on NASBA website for the application. While you are going to apply on Montana Board, you would need to fill in some forms / affidavits and send these to them after applying.

The issue is that 2 out of 4 forms needed to be notarized. Now, in Kuwait, there are no public notarization rules thus it was an issue for me to get these notarize from here.

Good thing is you may get it notarized from Pakistan itself, which will save your time, efforts and lots of money. So make sure that these forms are notarized prior to sending it to Montana Board. You can get these forms from the Login and from the link here.

Time Management

Phew!!! That’s a lot of work. However, that’s not all. You need to make sure all these documents are with the Board within 30 days of application. To get this right, you need to work backwards. 30 days is the rule for application and your documents will be in your file for 1 year, so do not worry. However, if they do not receive these documents within 30 days of application, then your application fees shall be forfeited and you would be considered ineligible.

To understand the time management, let’s consider an example. Assume you applied on Montana Board on 20 December 2014 and all the requirements need to be with the Board prior to 20 January 2015. (30 days of application).

As FACS takes at least 8 weeks for the evaluation, you should consider sending them the documents by 31 October 2014. I would recommend sending it by 15 – 20 October 2014. As soon as they receive your documents, they will confirm to you for the receipt email. As soon as they dispatch the evaluation and your documents, they will inform the same to you too.

[Stephanie’s note: thankfully NIES is much faster, typically 1-2 weeks but please double check with them before hand]

UNA Fall 2014 Semester is open till 31 October 2014, means you need to submit your respective forms with UNA by 31 October 2014. I would recommend sending these forms to them on the same date i.e. 15 – 20 October 2014. The course should be completed by 5 December 2014 and they announce the results after 10 working days, i.e. by 19 December 2014. They would send your transcript to Montana Board by the same date or day after.

Both FASC evaluation and UNA transcripts are received by Montana Board within 1 – 2 working days. In the end, you may arrange to send the Montana Board forms to them by 12 December 2014, so they shall receive the details within 3-4 working days.

VOLLA!!! Insha Allah you shall receive your trophy (Notice to Schedule) within a week or so. Only after NTS, you shall apply for International testing.

Please note that the above example is just for the understanding purpose and there may be a few days up and down, but make sure you do not miss 30-day window.

Why Alaska?

For qualified CAs and ACCAs, Alaska still accept CA and ACCA as academic qualification. Thus you may need to visit Alaska page on NASBA for details. With respect to the evaluator, Educational Records Evaluation Services (ERES) accepts scanned copies of transcripts. You need to visit their website and get more information from there itself.

I cannot help much on this as I am not very sure of the proceedings on this. However, it was told to me that this is the best available option if you are a qualified CA. But please mind you, Alaska is Tier 1 state, which means; your passing grades will expire if you do not complete the credit hours for licensing.

End Words

I have jotted down what I can think of for the CPA eligibility requirements. I may have missed any step or requirement. If you come across any info or addition, please feel free to add. Moreover, if you still have any confusion, query or further guidance required, please contact me in the comment section below.

I would like to thank the following ladies (weird, no guys) without whom I would not be eligible. You would definitely come across with them if you follow my path ![:)]()

1. Stephanie Ng for her immense guidance and website ipassthecpaexam.com, a must to visit for CPA related stuff. I would highly, highly recommend to get her book How to pass the CPA exam (just US$ 27). This book is like the flashlight for all CPA related information and how to proceed with it. It will help you till you pass your exam.

2. Rhonda Willard, NASBA Evaluator, who very patiently replied all my queries and guided me on all steps.

3. Sharon Campbell, Program Director, UNA, who guided me well for all my UNA exam related queries and ensure my transcript is out to NASBA asap ![:)]()

I would also recommend to go through CPA Candidate Bulletin

for an understanding of CPA exam. It is the official guidance from NASBA.

I would also recommend to visit the following websites for more information and guidance:

BEST OF LUCK WITH YOUR QUEST!

Read CPA Eligibility Guide from a Pakistani Candidate on I Pass the CPA Exam!!

I am honored to have Leslie-Anne Rogers, in-house expert on CPA exam qualification service at

I am honored to have Leslie-Anne Rogers, in-house expert on CPA exam qualification service at

Solution #3: Volunteer to gain experience in the meantime.

Solution #3: Volunteer to gain experience in the meantime. IQEX Exam, which stands for stands for the International Qualification Examination, is a professional exam designed for CAs and CPAs in countries with reciprocal agreement the United States.

IQEX Exam, which stands for stands for the International Qualification Examination, is a professional exam designed for CAs and CPAs in countries with reciprocal agreement the United States.

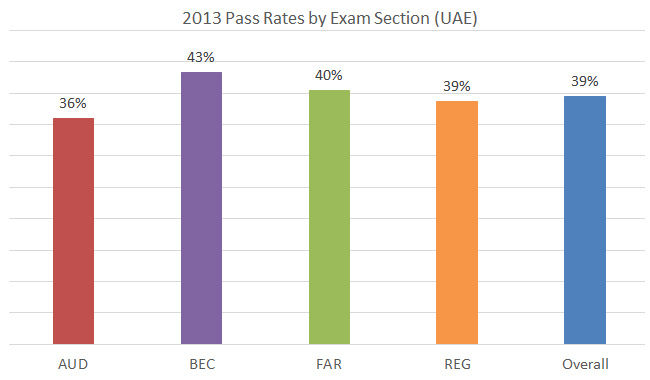

International CPA candidates, including US citizens who resides in foreign countries, have longed for an opportunity to take the CPA exam closer to home.

International CPA candidates, including US citizens who resides in foreign countries, have longed for an opportunity to take the CPA exam closer to home.

Can a 3-year bachelor degree (generally equivalent to an Associate degree) quality to sit for the CPA exam?

Can a 3-year bachelor degree (generally equivalent to an Associate degree) quality to sit for the CPA exam? If you want to go for jobs in the investment field, such as asset management, equity research analyst or hedge fund specialist, then you can consider

If you want to go for jobs in the investment field, such as asset management, equity research analyst or hedge fund specialist, then you can consider